What is Rapid Dispute Resolution (RDR), and can it aid in averting chargebacks for your business? How does it mesh with your existing dispute management tools?

Here's a streamlined overview of RDR and its potential influence on your business operations.

What is Rapid Dispute Resolution (RDR)?

-

What enhancements does Rapid Dispute Resolution (RDR) bring to my dispute response process?

-

What benefits does Rapid Dispute Resolution (RDR) bring to the customer experience?

-

Does Rapid Dispute Resolution (RDR) have the capability to stop chargebacks from occurring?

-

What sets Rapid Dispute Resolution (RDR) apart from legacy Verifi CDRN and Ethoca alerts?

How does RDR appear within my CRM/processor?

What is Rapid Dispute Resolution (RDR)?

RDR represents an enhancement to the pre-existing platform known as Chargeback Dispute Resolution Network (CDRN). In recent months, Visa has undergone a rebranding initiative, resulting in the renaming of several widely-used tools.

What is RDR?

RDR serves as a chargeback prevention tool developed by Verifi and distributed to merchants through various technology resellers

How does RDR work?

When an issuing bank initiates the chargeback process, the RDR platform enables your acquirer to automatically issue a credit to your customer.

Why choose RDR?

Utilizing RDR helps to maintain low Visa dispute counts. Moreover, participation demonstrates to your acquirer your dedication to promptly and proactively resolving disputes should they arise.

What are the benefits of Rapid Dispute Resolution (RDR)?

RDR is a revolutionary solution designed to revolutionize transactional benefits for all parties involved:

- Customers enjoy swift credits, enhancing their satisfaction.

- Issuing banks uphold customer contentment, fostering trust and loyalty.

- Acquiring banks uphold regulatory compliance, safeguarding merchant accounts.

- Merchants experience liberation from cumbersome manual processes, boosting efficiency and productivity.

What enhancements does Rapid Dispute Resolution (RDR) bring to my dispute response process?

RDR streamlines dispute resolution by automating the process. Before RDR, merchants had to manually assess and refund transaction disputes or face chargebacks, resulting in fees and penalties. With RDR, once the decision is made, the acquirer is automatically alerted to transfer customer credit funds to the issuer for eligible disputes, while the merchant's dispute ratio remains unaffected.

What benefits does Rapid Dispute Resolution (RDR) bring to the customer experience?

Before RDR, cardholders often endured lengthy waits of two to five days, or even longer, to receive refunds for disputes. However, with RDR, as soon as the issuer submits the dispute to Visa Resolve Online (VROL) and it meets the merchant's predefined criteria, the cardholder receives an immediate credit.

Does Rapid Dispute Resolution (RDR) have the capability to stop chargebacks from occurring?

Absolutely! RDR ensures that disputes are resolved swiftly by automatically issuing refunds, thereby preventing them from escalating into chargebacks. Additionally, disputes resolved through RDR don't impact the merchant's disputes-to-sales ratio.

Does Rapid Dispute Resolution (RDR) function with Mastercard, American Express, and Discover as well?

RDR, a product offered by Verifi, a Visa company, is designed to handle disputes processed through Visa Resolve Online (VROL). Therefore, it specifically addresses Visa transactions and does not extend to disputes related to American Express or other card networks.

What sets Rapid Dispute Resolution (RDR) apart from legacy Verifi CDRN and Ethoca alerts?

RDR, or Rapid Dispute Resolution, is specifically tailored to manage Visa transactions, offering an efficient solution within the Visa network. On the other hand, legacy Verifi alerts operate through their Cardholder Dispute Resolution Network™ (CDRN®), which may handle disputes from networks other than Visa. With legacy Verifi alerts, merchants often navigate to their payment gateway to manually process refunds for each alert received.

In contrast, RDR operates differently. It intervenes before a CDRN alert is issued, initiating direct credits to the cardholder through the merchant bank. This proactive approach streamlines the resolution process, bypassing the need for manual intervention. However, if RDR is not activated for a specific dispute, it then follows the traditional route through CDRN.

It's important to note that Ethoca primarily deals with managing Mastercard transactions. Consequently, disputes routed through Ethoca for Visa transactions are not covered by RDR. This distinction arises because RDR's credit triggers are facilitated through Visa Resolve Online (VROL), aligning specifically with Visa's dispute resolution infrastructure.

How does RDR appear within my CRM?

In every transaction, there are two banks involved: your merchant bank (acquiring bank) and the consumer's bank (issuing bank). Unlike Ethoca, RDR operates from the acquirer side, meaning that enrollment and actioning of alerts are managed by your payment processor, such as Stripe or Shopify Payments.

RDR comes into play later in the payment process, typically after Ethoca alerts (which arrive 6-8 days earlier). If you're refunding all Ethoca alerts, you should only be left with about 10-15% of RDR volume relative to Ethoca.

While card schemes like VISA and Mastercard do not classify RDR refunded transactions as chargebacks for their risk and fraud monitoring programs, not all payment processors consider RDR refunded transactions as non-disputes, as they occur later in the process. Modern payment processors tend to recognize them, but some older ones like Wells Fargo may not. Here's a partial list of processors compatible with RDR:

- Stripe

- Shopify

- Paddle

- Maverick Payments

- AirWallex

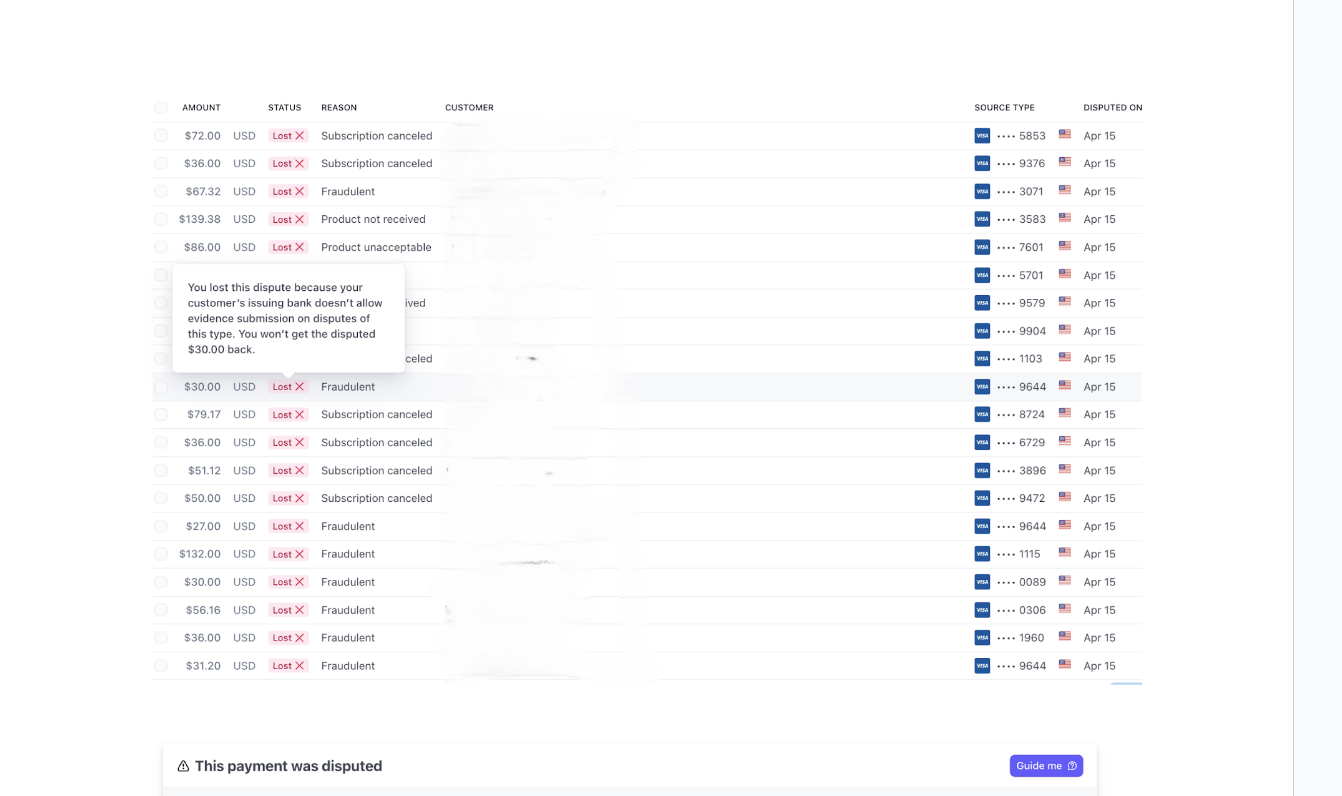

Each CRM may present RDR refunds differently, but most commonly, they appear as either a "chargeback lost" or an "unchallengeable dispute."

-

Stripe

On Stripe, you'll receive an email notifying you that the dispute is unchallengeable due to enrollment in Visa's RDR program.

In the disputes section of your Stripe dashboard, the disputes associated with RDR will typically appear as "lost" cases. However, it's important to note that these disputes will not be factored into your overall dispute activity graph. Below are screenshots illustrating this:

.png)

-

Shopify

In Shopify, RDR refunds will be displayed under the label "chargeback lost," as illustrated in the screenshots provided below: