Properly customizing fraud management settings can lead to a higher number of approved transactions, as well as a decrease in chargebacks. However, it's important to note that the fraud management settings provided through Braintree are extremely basic. Using too many preset rules, especially for AVS, can lead to a huge amount of rejected transaction for legitimate orders.

That's why it's important to use an AI-powered fraud detection system in addition to conditional order acceptance rules through Braintree. This ensures you have multiple layers of protection, rejecting high risk orders through Braintree, and using a smarter fraud detection system for better analyzation of medium risk orders.

The following Braintree configuration is what we would recommend if you're also using the Disputifier AI-powered Fraud Analyzation tools.

If you are not, we'd recommend utilizing a different AI-powered fraud analyzation tool. Otherwise, you'll be rejecting far too many legitimate orders.

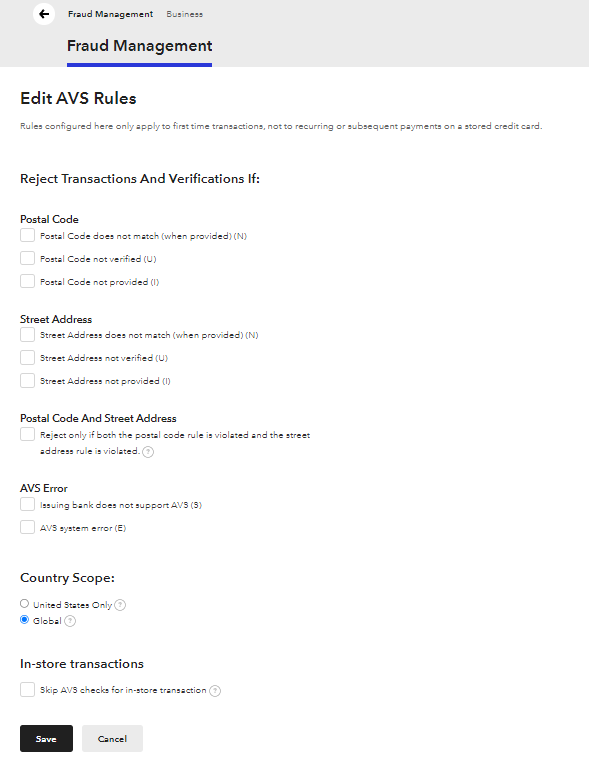

AVS Rules

No rules applied for AVS, as it's very common for real customers to input the incorrect billing address. This alone does not mean an order is fraudulent.

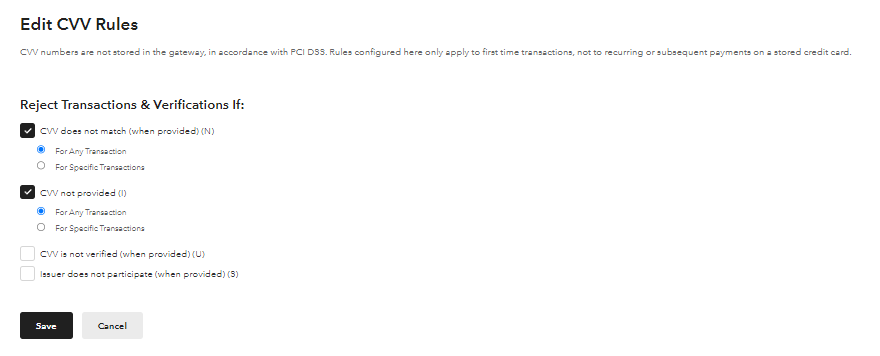

CVV Rules

Reject any transactions that do not have a matching CVV. This is an industry standard practice. Not rejecting these transaction will likely lead to an increase in fraud.