.jpg)

What are chargeback alerts?

Chargeback alerts are one of the most effective and direct chargeback prevention solutions.

All chargeback alert companies offer the same services. They are reselling alerts from two companies: Verifi (owned by Visa) and Ethoca (owned by Mastercard). It is normally cheaper for merchants to buy through a reseller instead of Verifi and Ethoca directly, unless the merchant is getting thousands of chargebacks per month.

A chargeback alert works by alerting merchants right after a customer files a chargeback, giving the merchant a chance to refund the order before the chargeback officially goes through.

This means that for any chargeback alerts refunded, the chargeback will not impact the merchant’s chargeback ratio.

We automatically refund these alerts to ensure that it is a fully hands-off prevention solution.

How do chargeback alerts work?

Verifi and Ethoca have partnered with thousands of worldwide banks to ensure that when a chargeback is filed for one of their clients, they are immediately notified.

We’ve seen that with both Verifi and Ethoca alerts enabled, it’s normal to reduce US chargebacks by 60-80% or even higher. This is because most US banks are partnered with Verifi and Ethoca. Your coverage in other countries will be less than this, especially in Asia/Africa/South America.

Verifi offers two different alert programs, CDRN and RDR. CDRN has become largely replaced by RDR but is still offered as a program. The main difference between CDRN and RDR is that RDR is normally cheaper and does not give you the option to reject a refund. With RDR, chargebacks are automatically refunded by Visa itself.

Both Verifi and Ethoca allow you to set rules for which chargebacks you’d like to be alerted about. For example, you can refund all alerts for Fraudulent chargebacks or all alerts for chargebacks under $100. This customization is not offered for CDRN alerts.

How much do chargeback alerts cost?

Please contact us for pricing on chargeback alerts.

For RDR alerts, your product category determines your pricing. Typically you'll be in tier 1 or 2 for most products and businesses.

What are the different RDR tiers?

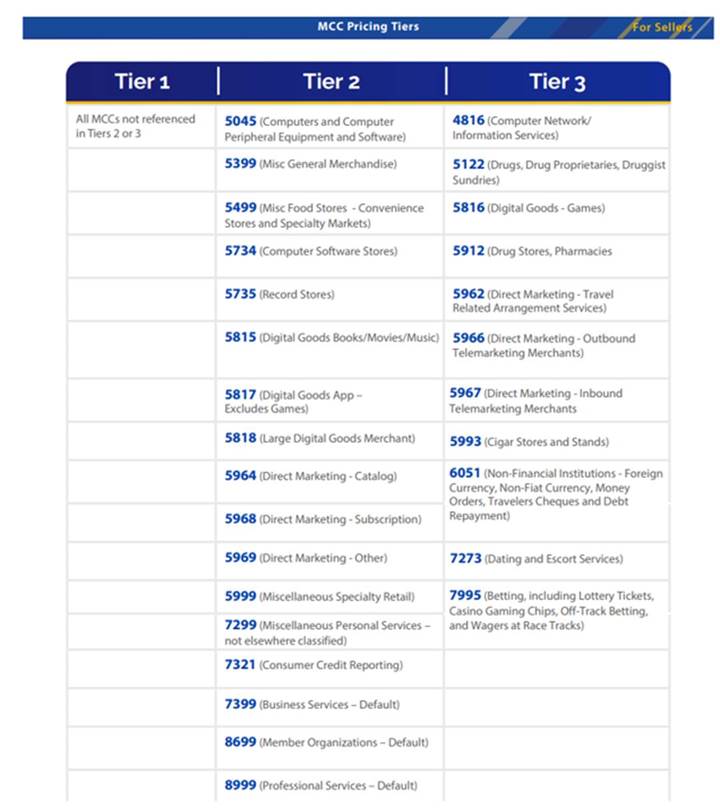

Pricing for RDR alerts is dependent on what type of business your payment processor has categorized you as. This is called your MCC Code. The higher risk categorizations have more expensive alerts. It is extremely rare to be in tier 3, most businesses will fall under tier 1 or 2.

.jpg)

Each MCC Code and its corresponding tier

How long do alerts take to set up?

CDRN and Ethoca alerts can be set up in around 24 business hours through Disputifier. RDR alerts take much longer because they require extensive setup and testing through Verifi. Normally it takes 5-10 business days to set up RDR alerts.

What features are offered through Disputifier?

Disputifier allows you to extensively customize what happens to each alert. You can choose to auto-refund all alerts with certain criteria or you can choose to be notified about certain alerts.

Additionally, we offer a Chargeback Alert Dashboard which will allow you to stay up to date on key analytics.

Lastly, we offer free subscription cancellations and blacklisting for customers that receive alerts.

Any questions? Want to set up alerts? Please reach out to the Disputifier team today!

hello@disputifier.com or click the live chat icon in the right hand corner!